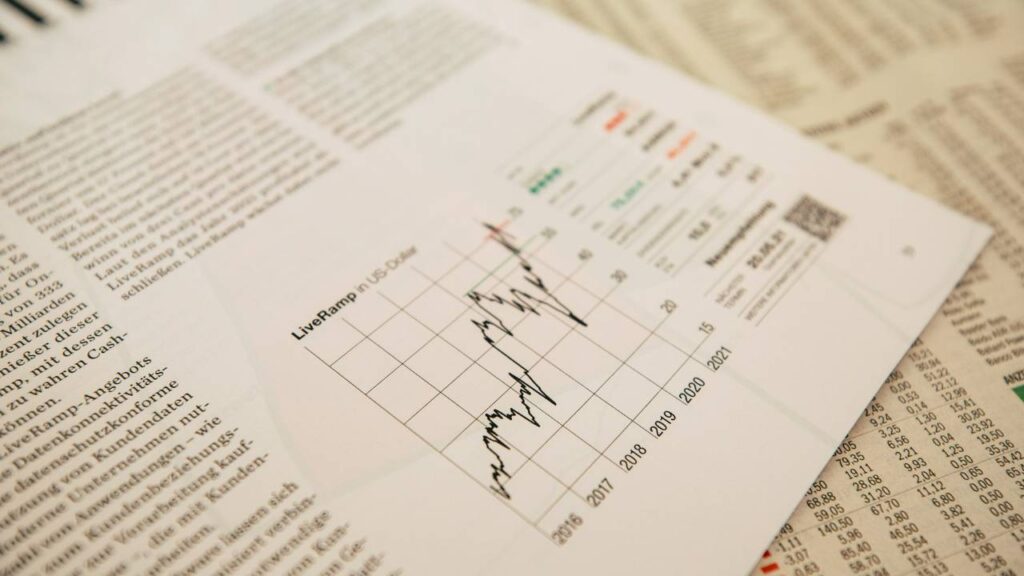

In today’s fast-paced world, staying financially sound is crucial if you want to thrive in the business environment. With a constantly shifting market and ever-evolving industry standards, it’s imperative that you equip your business with robust financial strategies. These strategies not just safeguard your business from unforeseen financial downturns but also propel you towards sustainable growth and profitability.

As an entrepreneur or business manager, understanding the financial underpinnings of your enterprise is foundational. This includes having a keen grasp on cash flow management, investment decisions, and cost control measures. It’s vital to build a financial framework that is both flexible and sturdy enough to withstand market fluctuations and adapt to new opportunities.

Securing your enterprise’s financial health involves an ongoing process of education, planning, and execution. It’s not merely about balancing the books at the end of the fiscal year. Your approach to financial strategy should encompass a comprehensive assessment of risks, opportunities, and competitive advantages. It’s about making informed decisions that align with your company’s values and objectives while navigating the economic landscape with agility and foresight.

Financial Management Foundations

In this section, you will explore the core aspects of financial management, from understanding cash flow to setting achievable financial goals, all geared towards bolstering your enterprise’s financial health.

Understanding Finance and Cash Flow

You need to comprehend the lifeblood of your business – cash flow. It’s the total amount of money being transferred in and out of your business. A healthy cash flow ensures you can pay your bills on time and keeps your operations running efficiently. You should be familiar with two types – operating cash flow, which relates to your day-to-day business activities, and investing cash flow, which concerns the money spent or earned from investments. Identifying how cash moves through your company allows you to make informed decisions and maintain financial health.

Budgeting and Forecasting Fundamentals

By crafting a thorough budget through financial modelling, you take the first step in driving your business towards profitability. Your budget serves as a financial roadmap, guiding you in allocating resources effectively. Incorporating realistic forecasting into your budgeting process is equally vital; it helps you anticipate future financial conditions and plan accordingly. Your ability to forecast potential financial outcomes can significantly improve your strategic financial planning, which drives both short-term efficiency and long-term growth.

Setting Clear Financial Goals

Your financial stability is dependent on setting clear, achievable financial goals. Consider these goals as your financial targets, which may include increasing revenue or reducing debt. Prioritising these objectives is important; make sure they are Specific, Measurable, Achievable, Relevant, and Time-bound (SMART). Align your financial strategies with your goals to ensure that every business decision you make contributes to your overarching ambition of financial robustness.

Financial Analysis and Reporting

To steer your business towards financial health, it’s crucial to keep a pulse on your company’s financial performance and adhere to regulatory compliance.

Key Performance Indicators (KPIs)

Using KPIs effectively is like having a financial compass for your business. They offer insights into the financial health of your enterprise and help you track progress against your strategic goals. Consider these KPIs:

- Gross Profit Margin – This quantifies your total revenue minus the cost of goods sold (COGS), divided by the total revenue. It measures the efficiency of your production process.

- Net Profit Margin – It reveals the amount of profit generated as a percentage of your revenue. This indicator shows your ability to turn revenue into profit after all expenses.

- Return on Investment (ROI) – This metric gauges the profitability of your investments. By dividing the net profit by the total assets, you’ll know if you’re effectively utilising your assets to generate earnings.

Financial Reporting, Tax Planning and Compliance

Your financial reporting serves as a clear mirror reflecting your business’s economic activities. It enables you to make informed decisions on budgeting and projections, ensuring accurate depiction of your revenue and expenditure. Customary financial statements include balance sheets, income statements, and cash flow statements.

Regarding tax planning, it’s pivotal for your financial management to account for tax obligations to maximise profitability. Addressing tax compliance proactively can prevent legal complications and potential fines down the line. For this purpose, you might look to the expertise of firms like SCK Group Dublin to support your financial accounting and uphold compliance, thereby ensuring your financial reporting accurately represents your business’s activities without any tax-related discrepancies.

Optimising Business Operations

In today’s marketplace, your ability to optimise business operations is crucial for both growth and competitiveness. This involves the astute management of resources and working capital, as well as the strategic investment in technology.

Efficiency and Resource Allocation

You’ll find that efficiency is about doing more with less. Resource allocation is a balancing act where your task is to assign tasks and assets in a manner that maximises output while minimising waste. This could involve streamlining processes, using time management techniques, or re-evaluating supply chain partnerships to ensure that every aspect of your business is contributing to a lean operation.

Working Capital and Liquidity Management

Your working capital and liquidity are the lifeblood of your enterprise, maintaining the smooth day-to-day operation of your business. Effective management ensures you have enough cash flow to meet your short-term obligations, like paying suppliers or employees. To improve liquidity, you could negotiate better payment terms with suppliers or expedite invoice payment collection from customers.

Investment in Technological Advancements

Investing in technological advancements can be a game-changer for your business. It not only enhances operational efficiency but can also open up new avenues for growth. By adopting modern solutions, like cloud computing or big data analytics, you can gain insights into customer behaviour, optimise your supply chain, and remain agile in a rapidly evolving commercial landscape. Remember, the goal is to adopt technology that aligns with your business objectives and boosts productivity.

Risk Management and Growth Strategies

Navigating the unpredictable waters of business requires a delicate balance between recognising opportunities for growth and mitigating potential risks caused by the market’s volatility. Your ability to thrive hinges on understanding market dynamics while fostering financial resilience.

Balancing Risk and Profit

When managing your enterprise’s finances, it’s crucial to find a middle ground that allows for profit maximisation while keeping risks in check. Begin by conducting a thorough risk assessment to identify potential threats across all investment avenues. Prioritising a portfolio that’s diversified across different asset classes can help mitigate risks related to market fluctuations. Regularly evaluate your performance metrics to ensure that your risk management strategies align with your profitability goals.

Market Dynamics and Financial Resilience

The financial markets are influenced by a myriad of factors that can affect your enterprise’s growth and stability. As you manoeuvre through these dynamics, safeguard your financial health by maintaining a robust credit profile, which is vital for accessing capital when seizing growth opportunities or weathering downturns. Understand that investments can be susceptible to market volatility; hence, a cushion of reserves can provide the resilience needed to sustain operations during turbulent times. Stay abreast of market trends to anticipate changes and adjust your strategies accordingly, ensuring sustained growth and competitive advantage.

Strategic Fiscal Opportunities

To harness the full potential of financial strategies, it’s paramount for your enterprise to seize strategic fiscal opportunities that drive profit and ensure sustainable growth.

Exploring Investment Opportunities

Your company’s capacity to identify and capitalise on investment opportunities can significantly influence its financial trajectory. A robust investment strategy may involve allocating funds into emerging markets or innovative technologies that promise high returns. It’s prudent for you to conduct a thorough market analysis and risk assessment before committing resources, ensuring alignment with your enterprise’s long-term objectives.

Innovative Tax Incentives and Debt Management

Understanding and utilising tax incentives can be a game-changer for your business’s net profit margins. Be sure to stay informed about new tax legislation that may offer deductions or credits relevant to your industry. Efficient debt management includes refinancing options, which can reduce your interest payments and improve cash flow. You could also explore debt consolidation to simplify your liabilities, potentially easing your repayment schedule and enhancing financial stability.

Strengthening Shareholder Value

Ultimately, your decisions in the area of business finance design should aim to bolster shareholder value. Implementing strategies such as share buybacks or increasing dividend payouts can make your company more attractive to investors. Coupled with transparent financial reporting and a clear dividend policy, these approaches signal to shareholders that their investments are well-managed and have the potential for appreciable growth.